Unlocking Prospect: How Justin Ferguson is Reshaping Virginia Industrial Real Estate By Strategic Multifamily and Winery Investment

Introduction

Did you know that multifamily investments accounted for virtually 40% of all professional real-estate transactions in the U.S. lately? As demand for diversified profits streams and resilient assets grows, buyers are progressively turning to Virginia industrial housing—a area rich in prospect, each in city and rural landscapes.

A single identify that constantly emerges During this Room is Justin Ferguson, a seasoned expert in Virginia professional real-estate, specializing in multifamily portfolios. Beyond property, Ferguson holds a WSET Stage three certification in wine, offering exclusive winery consulting products and services that Mix company system with oenological knowledge. This article explores how Ferguson empowers company specialists, developers, REITs, syndicators, and personal traders to improve and diversify their holdings—effectively and profitably.

The Increase of Multifamily Investments in Virginia Industrial Property

Why Virginia?

Virginia commercial housing is undergoing a change. With thriving metro regions like Northern Virginia, Richmond, and Norfolk—and picturesque rural zones ideal for vineyards—Virginia offers a dynamic financial investment landscape. Essential motorists consist of:

A rising population fueled by tech and federal government jobs.

Robust rental need in urban and suburban corridors.

Favorable tax and development insurance policies.

Multifamily Property: The Core of a wise Portfolio

Justin Ferguson specializes in figuring out and optimizing multifamily belongings—a cornerstone of Virginia professional housing. Irrespective of whether advising REITs or guiding very first-time buyers, his approach centers on:

Significant-yield chances in up-and-coming neighborhoods.

Strategic renovations to enhance house benefit and rental profits.

Navigating zoning and local polices with small friction.

According to Ferguson, “Multifamily properties in Virginia offer probably the greatest risk-modified returns in The existing marketplace.”

Ferguson’s Consumers: Who He Helps And the way

Company Gurus Searching for Passive Cash flow

Lots of Ferguson’s clientele are active industry experts who lack time to control housing. He streamlines the process by supplying:

Thorough sector analysis.

Turnkey investment Click Here decision alternatives.

Dependable property management referrals.

Traders and Syndicators Scaling Competently

Efficiency is key when scaling a Virginia industrial real estate property portfolio. Ferguson’s working experience helps syndicators and institutional traders:

Supply undervalued or off-current market promotions.

Structure funding To optimize returns.

Decrease operational charges when maximizing income stream.

Builders and REITs Needing Nearby Know-how

Navigating growth approvals and current market traits can be daunting. Ferguson gives:

In-depth market place exploration.

Feasibility experiments.

Coordination with architects, planners, and contractors.

The Vineyard Advantage: Wine Investment decision in Virginia Industrial Real estate property

A Accredited Sommelier’s Strategic Lens

Ferguson’s uncommon combination of real estate property and wine know-how sets him apart. As a WSET Degree 3 Accredited sommelier, he delivers financial investment-grade vineyard consulting that appeals to large-Internet-value persons and agribusiness builders alike.

Why Vineyards in Virginia?

Virginia is the fifth-largest wine-creating condition while in the U.S., and its wine tourism sector is booming. Purchasing vineyards throughout the scope of Virginia professional real estate features:

Robust ROI by way of wine creation and tourism.

Land appreciation in scenic, fascinating parts.

Synergy with hospitality ventures like inns or tasting rooms.

Winery Financial investment Services Include:

Website choice depending on terroir and zoning.

Grape varietal suggestions.

Organization arranging and market place positioning.

“The wine marketplace Here's not pretty much Way of living—it’s about legacy and extensive-time period money,” Ferguson suggests.

Vital Benefits of Dealing with Justin Ferguson

Here’s why Ferguson stands out in the Virginia commercial real estate market:

Dual Expertise: Real estate acumen + wine industry credentials.

Tailored Strategy: Every consumer gets a customized investment decision roadmap.

Neighborhood Information: A long time of expertise navigating Virginia's special housing dynamics.

Performance-Pushed: Centered on maximizing ROI with negligible downtime.

Investor Insights: Recommendations for Success in Virginia Commercial Real-estate

To prosper Within this competitive marketplace, Ferguson recommends:

Start with a clear financial investment intention—Dollars stream? Appreciation? Tax Positive aspects?

Target developing areas with infrastructure improvements and occupation growth.

Husband or wife with area gurus like Ferguson to navigate purple tape and stay clear of popular pitfalls.

Speedy Checklist for Multifamily and Winery Expenditure:

✅ Carry out a detailed market analysis.

✅ Examine residence issue and enhancement prospective.

✅ Comprehend local tax incentives and zoning guidelines.

✅ Align investment with extensive-phrase Way of life or financial plans.

Summary

The evolving landscape of Virginia industrial property is ripe with possibilities—from multifamily models in vivid city centers to boutique vineyards nestled in the Blue Ridge foothills. With Justin Ferguson’s twin-pronged abilities, traders can tap into this potential with assurance and clarity.

No matter if you’re a company Expert seeking passive money, a syndicator aiming to scale, or possibly a dreamer Prepared to invest in wine state, Ferguson’s strategic tactic assures your expense journey is as smooth for a wonderful vintage.

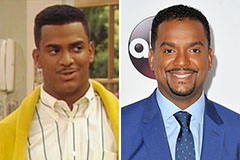

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!